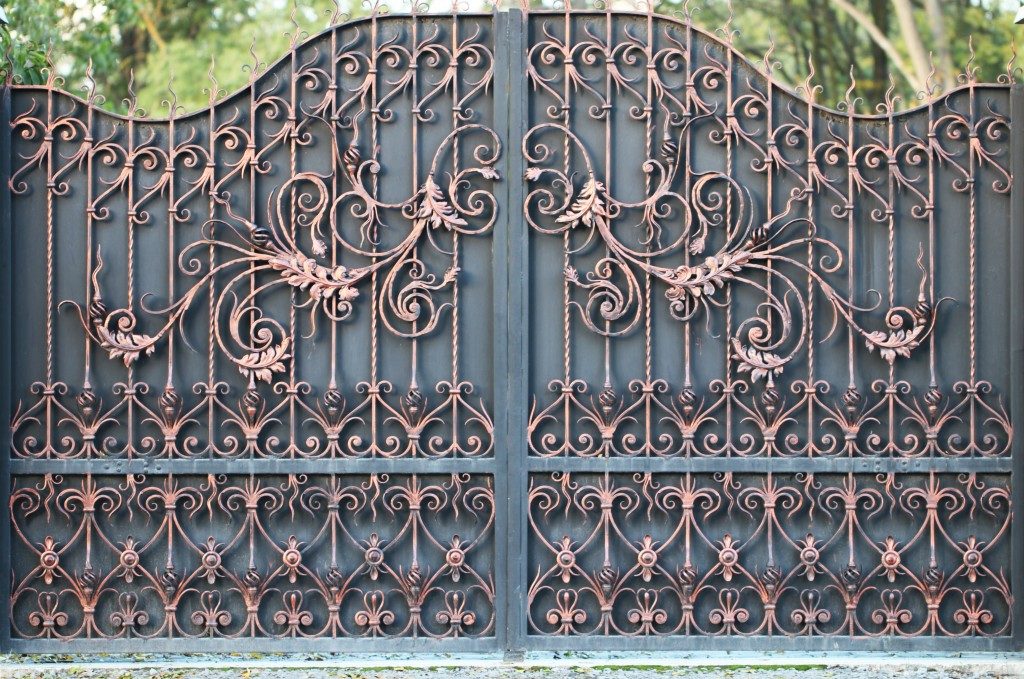

When it comes to estate planning, there are many things to consider. You have to think about who will inherit your property and how they will receive it. One option is to gift your estate to your family. This can be a great way to pass on your legacy and ensure that your loved ones are taken care of after you’re gone.

However, there are a few things you need to keep in mind if you’re planning to gift your estate to your family. Here are five things you should do before you make any decisions:

Assess How Much Your Estate is Worth

Make sure you have a clear understanding of your financial situation and what your estate is worth. This will help ensure that you can make an informed decision about what to do with your estate before you decide to gift it to your family.

Your estate comprises all the property — including money, investments, and real estate — that you own. By taking inventory of your assets and debts, you’ll get a good net worth estimate. This means considering what you own and any obligations or other liabilities you may have.

Once you know your net worth, you can think about how much of your estate you’d like to gift to your family. If you skip this step, you may give more than you can afford or leave your loved ones with a financial burden they’re unprepared to handle.

Know Your Family’s Financial Situation

Before you make any decisions, it’s essential to know your family’s financial situation because this will help you determine if they can handle an inheritance. You should also be aware of any potential financial problems that could arise if you were to gift your estate to your family.

For example, if one of your children is facing bankruptcy, it’s essential to consider how this would affect the rest of your family. This is because your child’s creditors could go after your estate if they were to inherit it.

You should also be aware of any family member who may have a spending problem. If you gifted your estate to someone unable to manage their finances, it could be squandered away. That’s why it’s crucial to have a frank discussion with your family about their financial situation before making any decisions.

Understand the Tax Implications

Gifting your estate to your family can have tax implications. It’s essential to consult with a tax advisor to understand how this could affect your family. And you should also be aware of any gifts exempt from taxation, such as those made to a spouse or charity.

In general, gifts are subject to the federal gift tax. This means that you’ll have to pay taxes on the value of any gifts you give to your family. However, there are some exemptions to this rule. For example, you’re allowed to give each family member a certain amount of money each year without incurring any tax liability.

You should also be aware of the estate tax. This is a tax that’s levied on your estate when you die. If your estate is valued over a certain amount, your family will have to pay taxes. However, there are ways to minimize the impact of this tax, such as by setting up a trust.

Consider Your Family’s Future

When deciding on your estate, it’s crucial to think about your family’s future. For example, if you have young children, you may want to consider setting up a trust fund to help with their education. Or, if you’re going to divide your properties among your children, you may want to wait until they’re older and can handle the responsibility.

You should also consult a conveyancing solicitor about any legal implications of gifting your estate to your family. There may be some restrictions on what you can do with your property, depending on your jurisdiction.

It’s also essential to think about any potential changes in your family’s circumstances. Suppose you have a child with special needs. In this case, you may want to make sure that they’re taken care of financially if something happens to you.

Talk to Your Family About Your Plans

Once you’ve decided what you want to do with your estate, it’s important to talk to your family about your plans. This will help them understand your decision and give them time to prepare for any changes, including financial ones.

It’s also a good idea to have a lawyer draw up a contract outlining the terms of your gift. There can be no misunderstanding about what you’ve given and what your family is responsible for. And if you change your mind about your decision, you can simply revoke the contract.

Deciding on your estate is a big step, but it doesn’t have to be complicated. If you’re thinking about gifting your estate to your family, there are what you should consider before making your decision. After all, your estate is a big responsibility, and you want to make sure that your family is prepared to handle it.